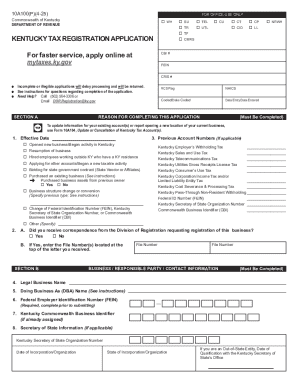

Who needs a 10A100(P) form?

The Kentucky Tax Registration Application is used by the taxpayers who want to open a certain tax account connected with their business activity.

What is the purpose of the 10A100(P) form?

This form is used to apply for the employer’s withholding tax account, sales and use tax account, motor vehicle tire fee account, telecommunication tax account, utility gross receipts license tax account, consumer’s use tax account, etc. You can check the full list in the form’s instructions. The application provides details about the business entity, tax accounts, and other required business information.

What other documents must accompany the 10A100(P) form?

As a rule, this form is accompanied by other supporting forms and documents depending on the type of your business organization.

When is the 10A100(P) form due?

The taxpayer has to file this application not later than 30 days before starting in an activity that needs an appropriate business account. Keep in mind that the time for proceeding the application takes from five up to ten days.

What sections should I fill out in 10A100(P) form?

- The given application has the following sections for completion:

- Reason for completing (check the appropriate box)

- Business/responsible party/contact information (business name, Federal Employer Identification Number, Secretary of State, business location, business structure, ownership disclosure-responsible parties)

- Detailed information about the business (answer the questions and follow the instructions)

- Information about the tax account of the business entity (depending on its type)

The application must be signed by the authorized person as well.

What do I do with the form 10A100(P) after its completion?

The completed application is sent to Kentucky Department of Revenue, Taxable Registration Section.